45 duration of a coupon bond

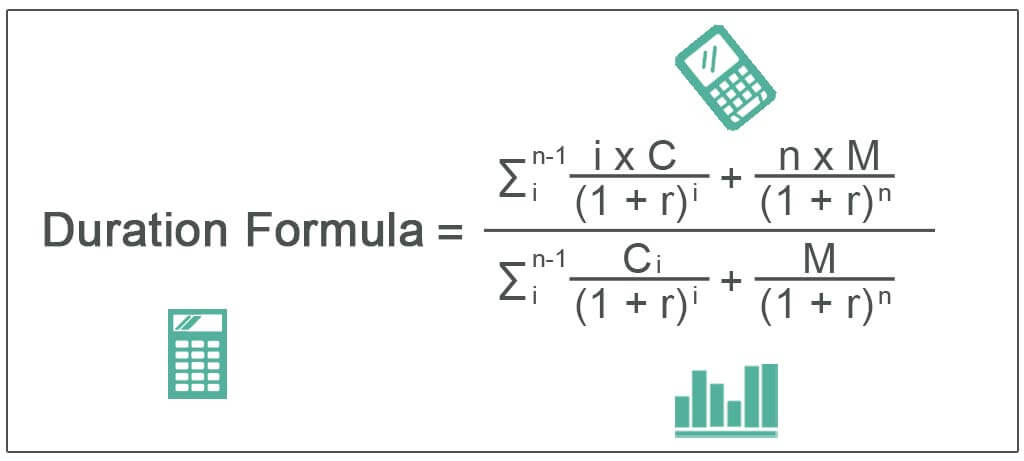

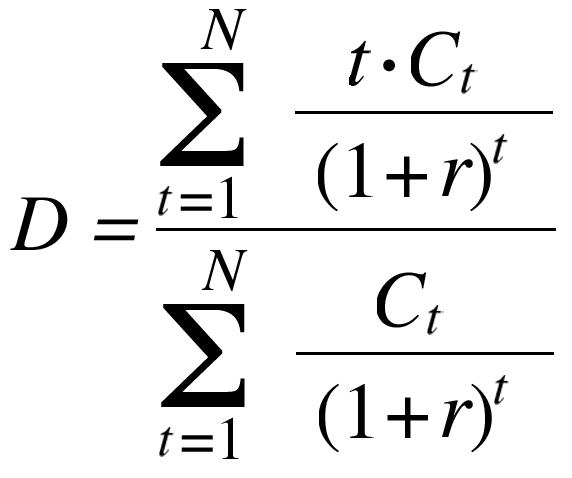

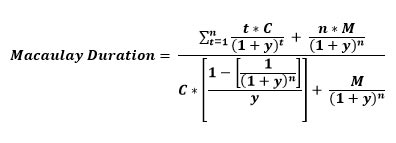

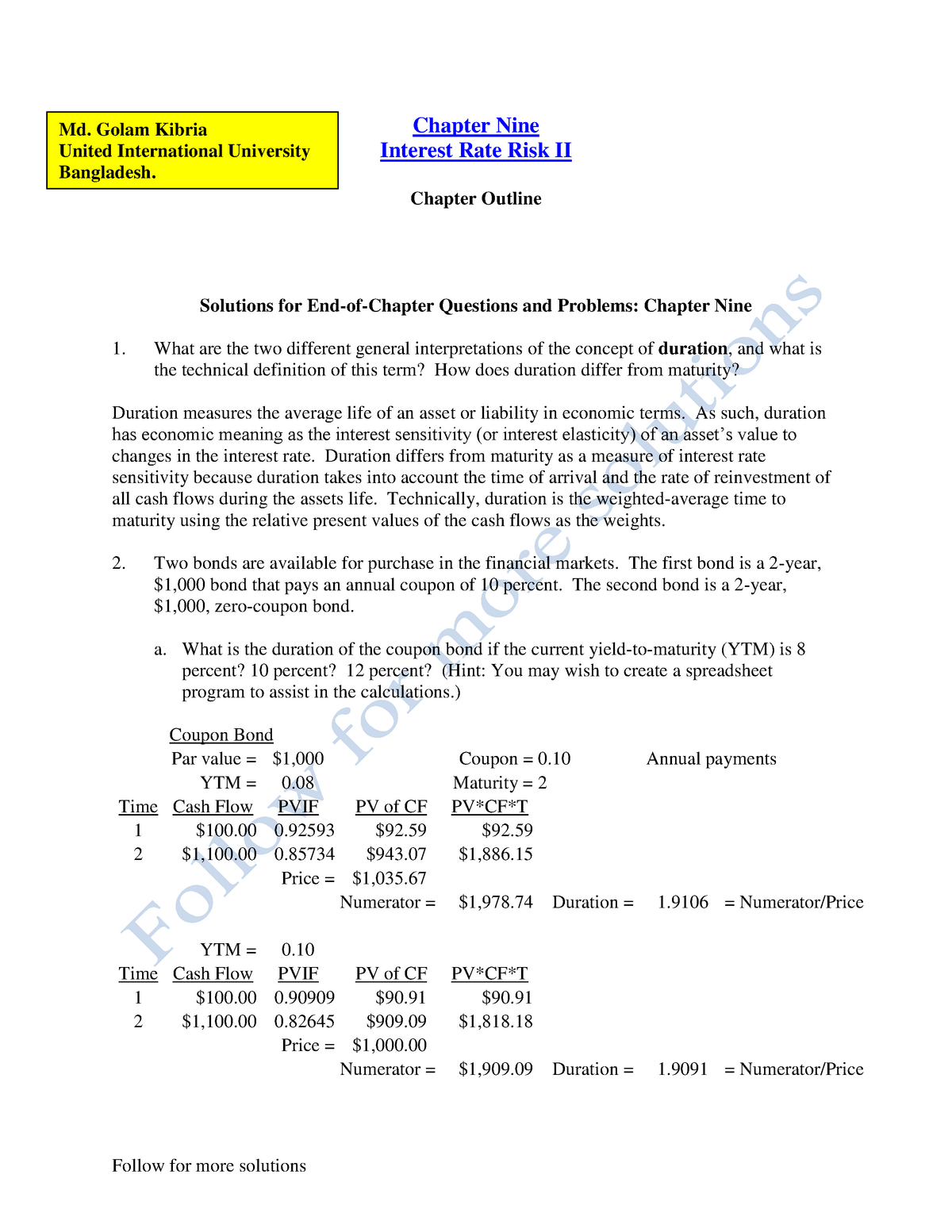

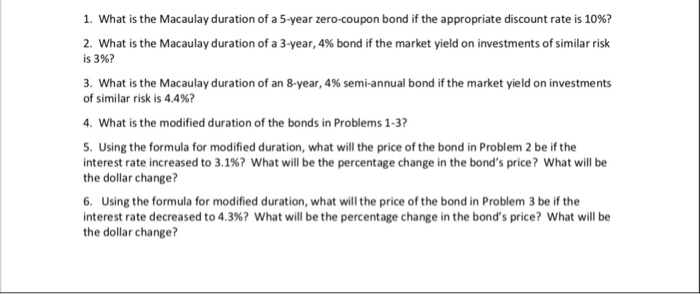

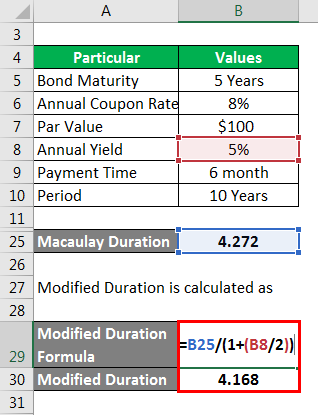

support.microsoft.com › en-us › officeDURATION function - Microsoft Support The DURATION function, one of the Financial functions, returns the Macauley duration for an assumed par value of $100. Duration is defined as the weighted average of the present value of cash flows, and is used as a measure of a bond price's response to changes in yield. Syntax. DURATION(settlement, maturity, coupon, yld, frequency, [basis]) Modified Duration - Overview, Formula, How To Interpret Below is an example of calculating Macaulay duration on a bond. Example of Macaulay Duration. Tim holds a 5-year bond with a face value of $1,000 and an annual coupon rate of 5%. The current rate of interest is 7%, and Tim would like to determine the Macaulay duration of the bond. The calculation is given below: The Macaulay duration for the 5 ...

Bond Duration Calculator – Macaulay and Modified Duration From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity – it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

Duration of a coupon bond

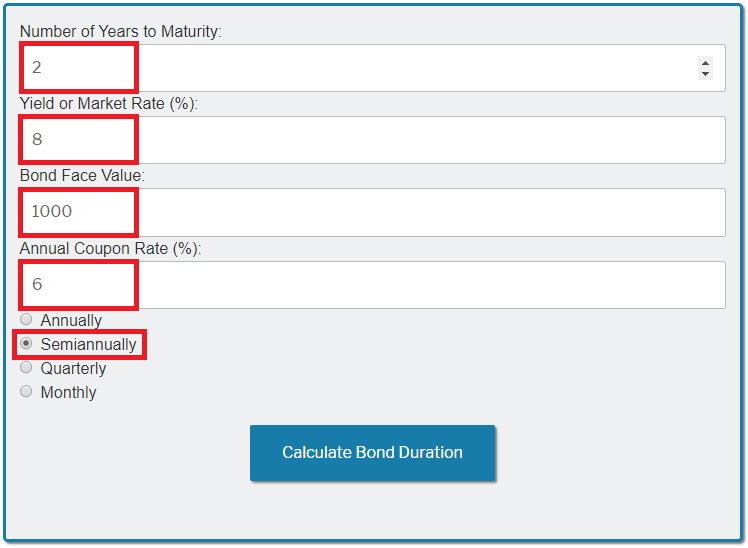

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. Bond Duration Calculator - Exploring Finance Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually (1) What is the bond’s Macaulay Duration? (2) What is the bond’s Modified Duration? You can easily calculate the bond duration using the Bond Duration Calculator. …

Duration of a coupon bond. Duration of a Bond | Portfolio Duration | Macaulay & Modified Duration Therefore, the Macaulay bond duration = 482.95/100 = 4.82 years. And Modified Duration= 4.82/ (1+6%) = 4.55%. The above calculations roughly convey that a bondholder needs to be invested for 4.82 years to recover the cost of the bond. Also, for every 1% movement in interest rates, the bond price will move by 4.55% in the opposite direction. Bond Duration | Formula | Excel | Example - XPLAIND.com Duration doesn't simply equal the term of the fixed income security except in case of a zero-coupon bond where it equals the term of the bond. In all other cases, where there are periodic payments in addition to the final balloon payment, duration is lower than the term of the fixed income instrument. What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. How to Calculate Bond Duration - wikiHow 23.11.2022 · Clarify coupon payment details. To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder). The number of payments can be calculated as ...

Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Bond Duration Calculator - Exploring Finance PV= Bond price = 963.7 FV= Bond face value = 1000 C= Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4=tn= 2 years › fixed-income-bonds › durationDuration: Understanding the relationship between bond prices ... That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · Duration indicates the years it takes to receive a bond’s true cost, weighing in the present value of all future coupon and principal payments. more Understanding Par Value of Stocks and Bonds

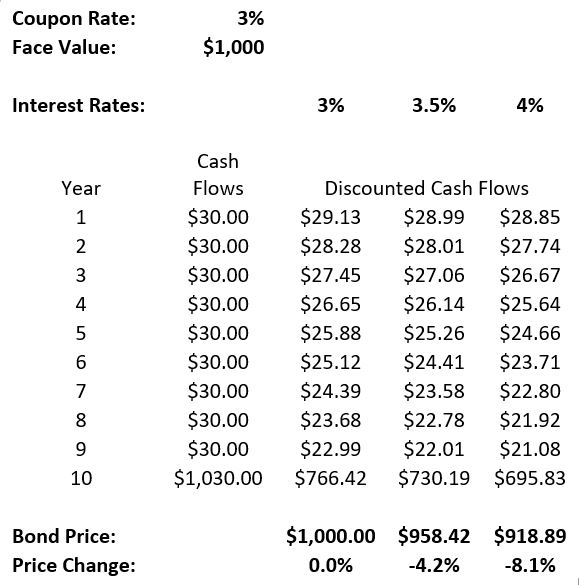

Bond duration - Wikipedia For example, a standard ten-year coupon bond will have a Macaulay duration of somewhat but not dramatically less than 10 years and from this, we can infer that the modified duration (price sensitivity) will also be somewhat but not dramatically less than 10%. Similarly, a two-year coupon bond will have a Macaulay duration of somewhat below 2 years and a modified … Duration and Convexity to Measure Bond Risk - Investopedia 22.06.2022 · With coupon bonds, investors rely on a metric known as duration to measure a bond's price sensitivity to changes in interest rates.Because a coupon bond makes a series of payments over its ... Duration | Definition & Examples | InvestingAnswers The lower the coupon, the longer the duration (and volatility). Zero-coupon bonds - which have only one cash flow - have durations equal to their maturities. 2. Maturity. The longer a bond's maturity, the greater its duration and volatility. Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity. The Macaulay Duration of a Zero-Coupon Bond in Excel 29.08.2022 · As a bond's coupon increases, its duration decreases. As interest rates increase, duration decreases, and the bond's sensitivity to further interest rate increases goes down. Other factors, such ...

Duration Formula (Excel Examples) | Calculate Duration of Bond Calculation of the numerator of the Duration formula will be as follows - = 292,469.09 Therefore, the calculation of the duration of the bond will be as below, Duration Formula = 292,469.09 / 78,248.75 Duration = 3.74 years From the example, it can be seen that the duration of a bond increases with the decrease in coupon rate.

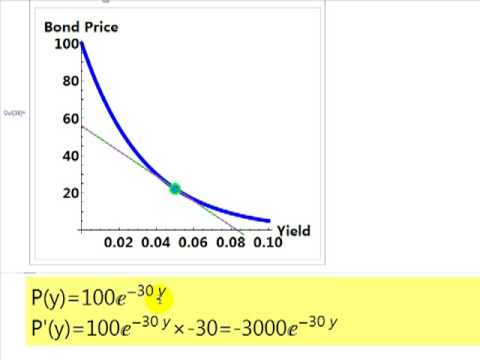

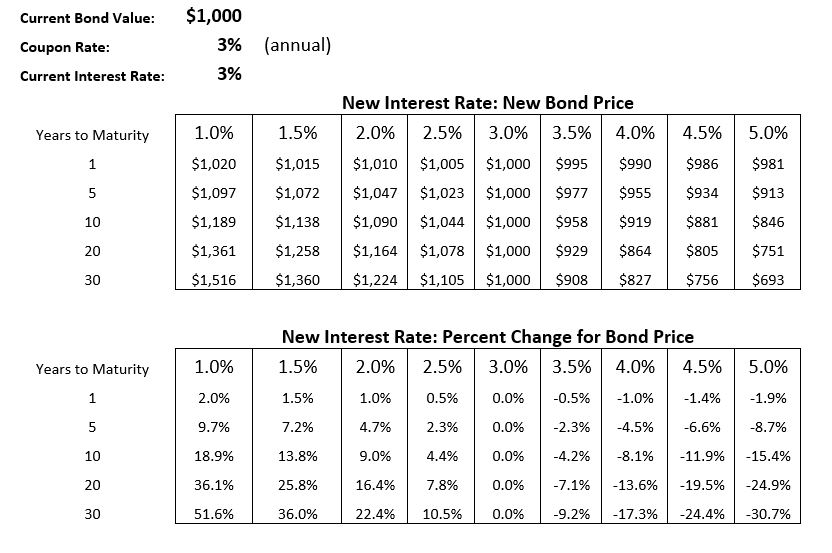

Understanding bond duration - Education | BlackRock It's lost some appeal (and value) in the marketplace. Duration is measured in years. Generally, the higher the duration of a bond or a bond fund (meaning the longer you need to wait for the payment of coupons and return of principal), the more its price will drop as interest rates rise. How duration affects the price of your bonds

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Formula We can calculate the Present value by using the below-mentioned formula: Zero-Coupon Bond Value =Maturity Value/ (1+i)^ Number of Years You are free to use this image on your website, templates, etc, Please provide us with an attribution link Example Let's understand the concept of this Bond with the help of an example:

The dynamics of bond duration and rising rates | Vanguard 18.11.2021 · Your investment horizon matters. Rising interest rates can be good for bond investors if their investment horizon is long enough. Figure 1 shows the effect of the investment horizon on a hypothetical investment in a bond maturing in 15 years that pays a coupon of 0.9% annually when interest rates are at 2%. The bond’s weighted average Macaulay duration is 14 …

Duration - Definition, Types (Macaulay, Modified, Effective) It is a measure of the time required for an investor to be repaid the bond's price by the bond's total cash flows. The Macaulay duration is measured in units of time (e.g., years). The Macaulay duration for coupon-paying bonds is always lower than the bond's time to maturity. For zero-coupon bonds, the duration equals the time to maturity.

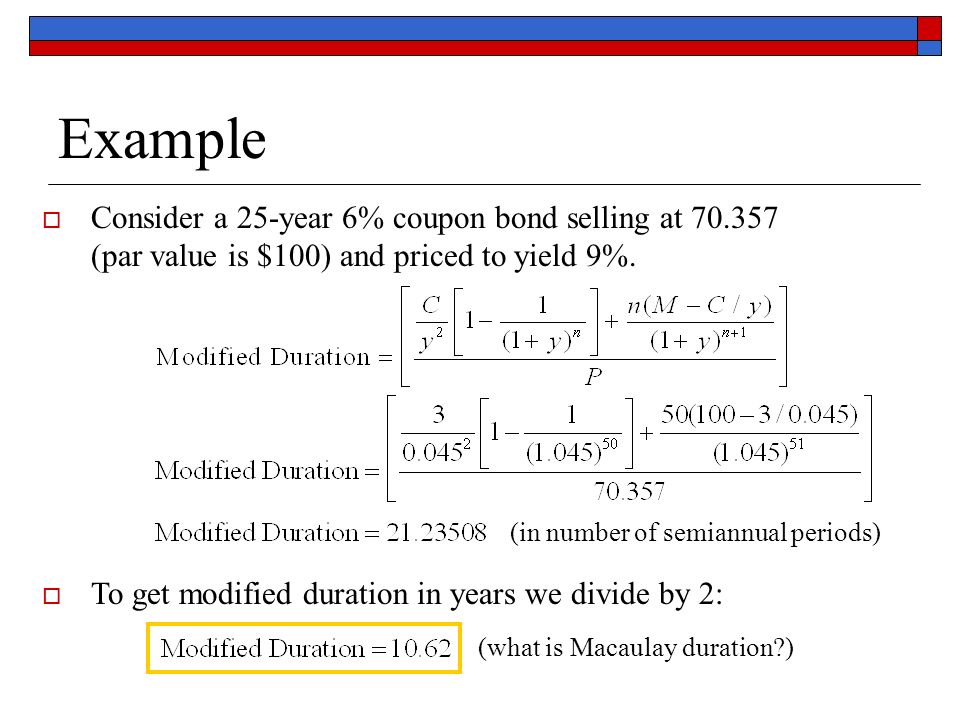

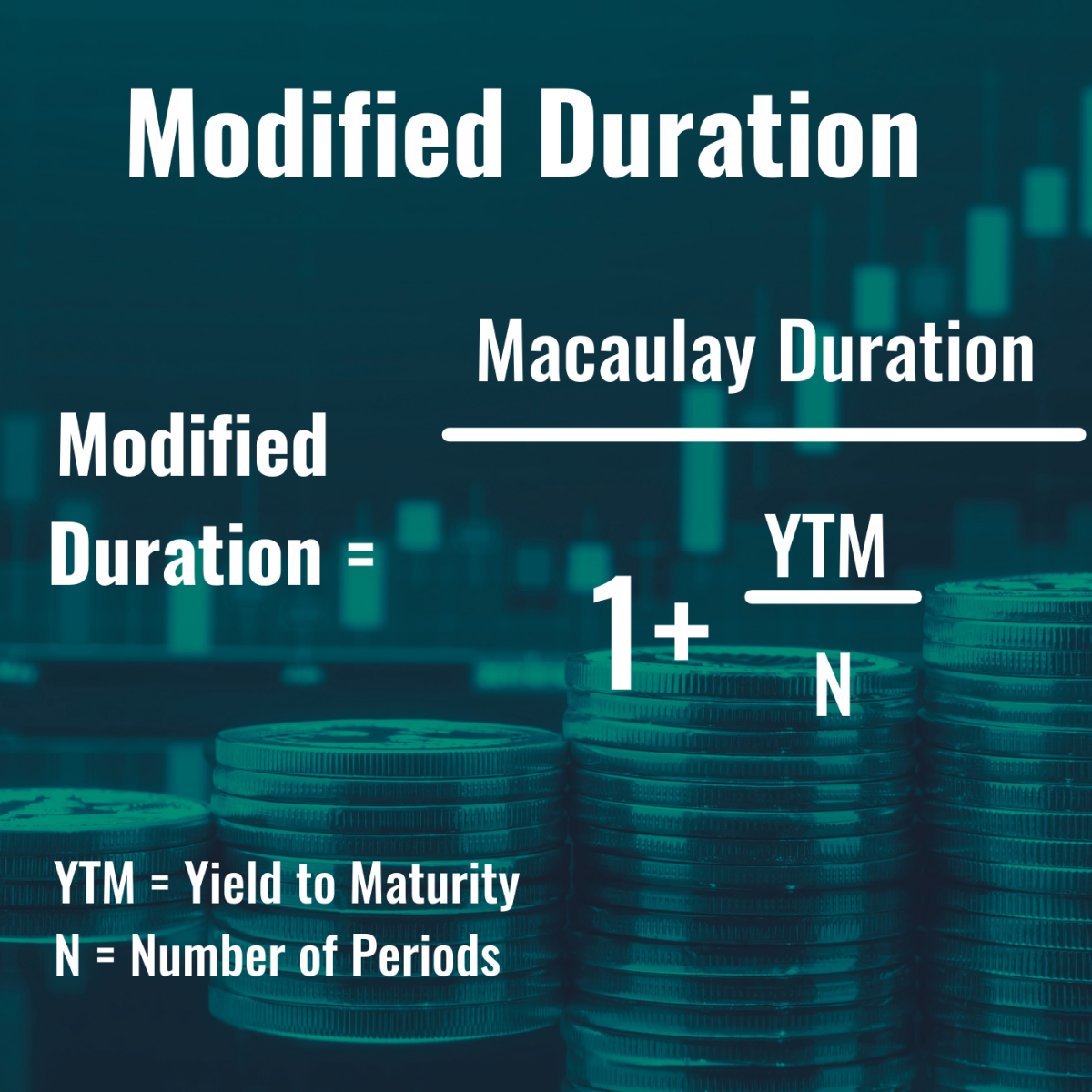

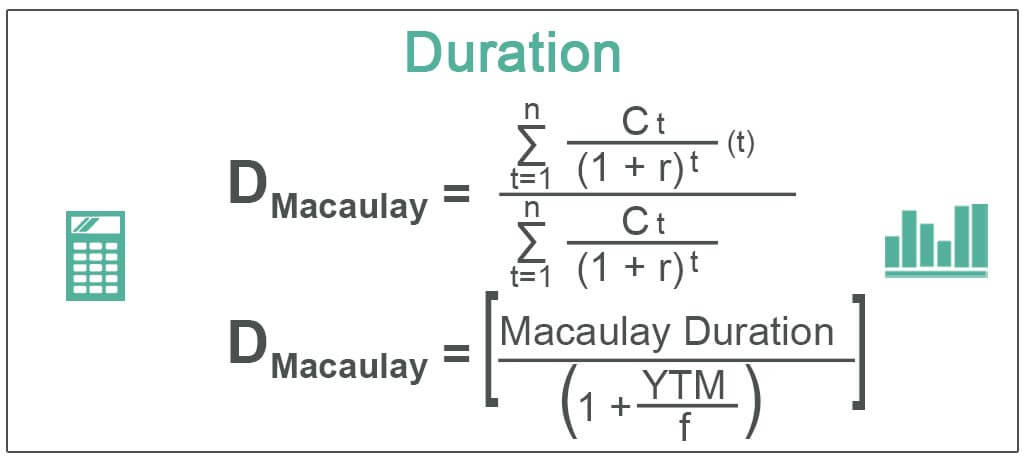

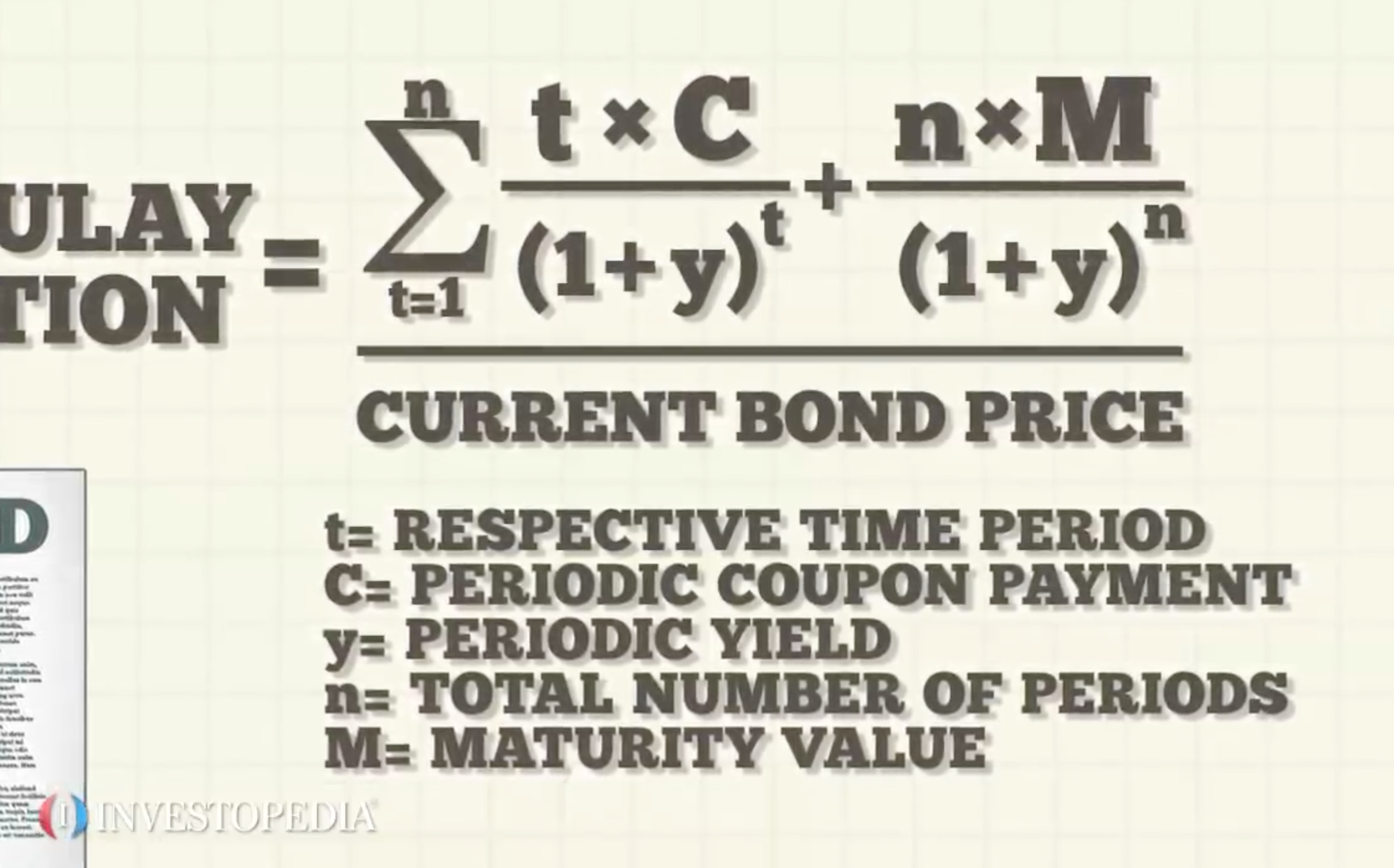

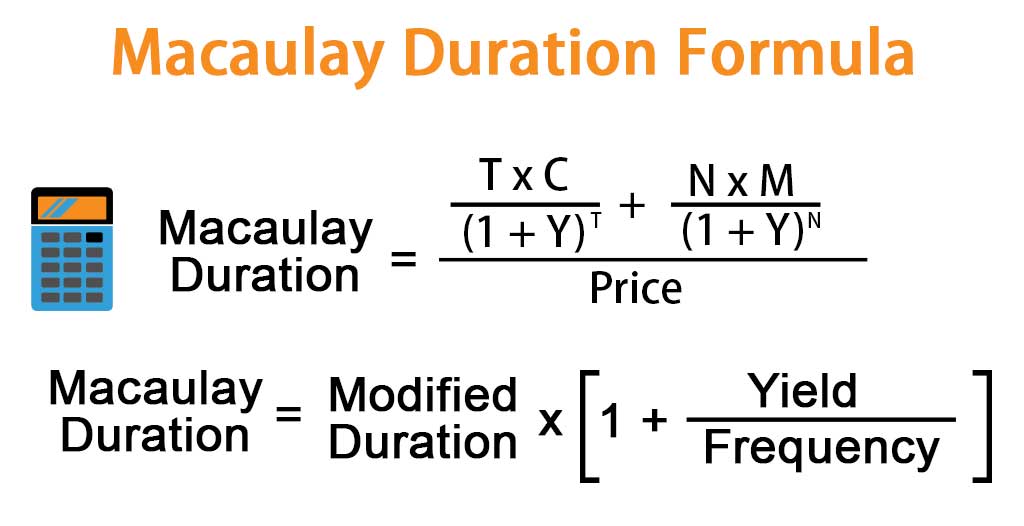

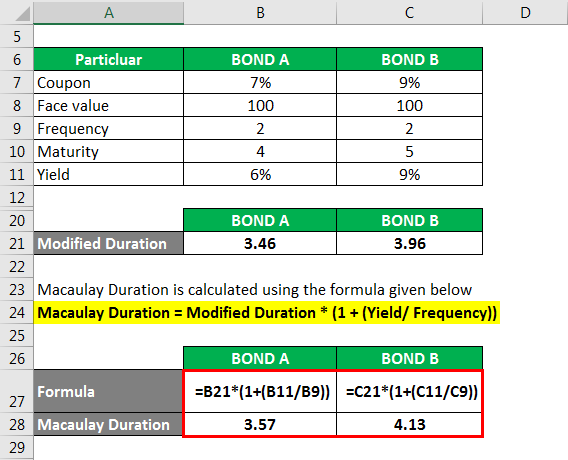

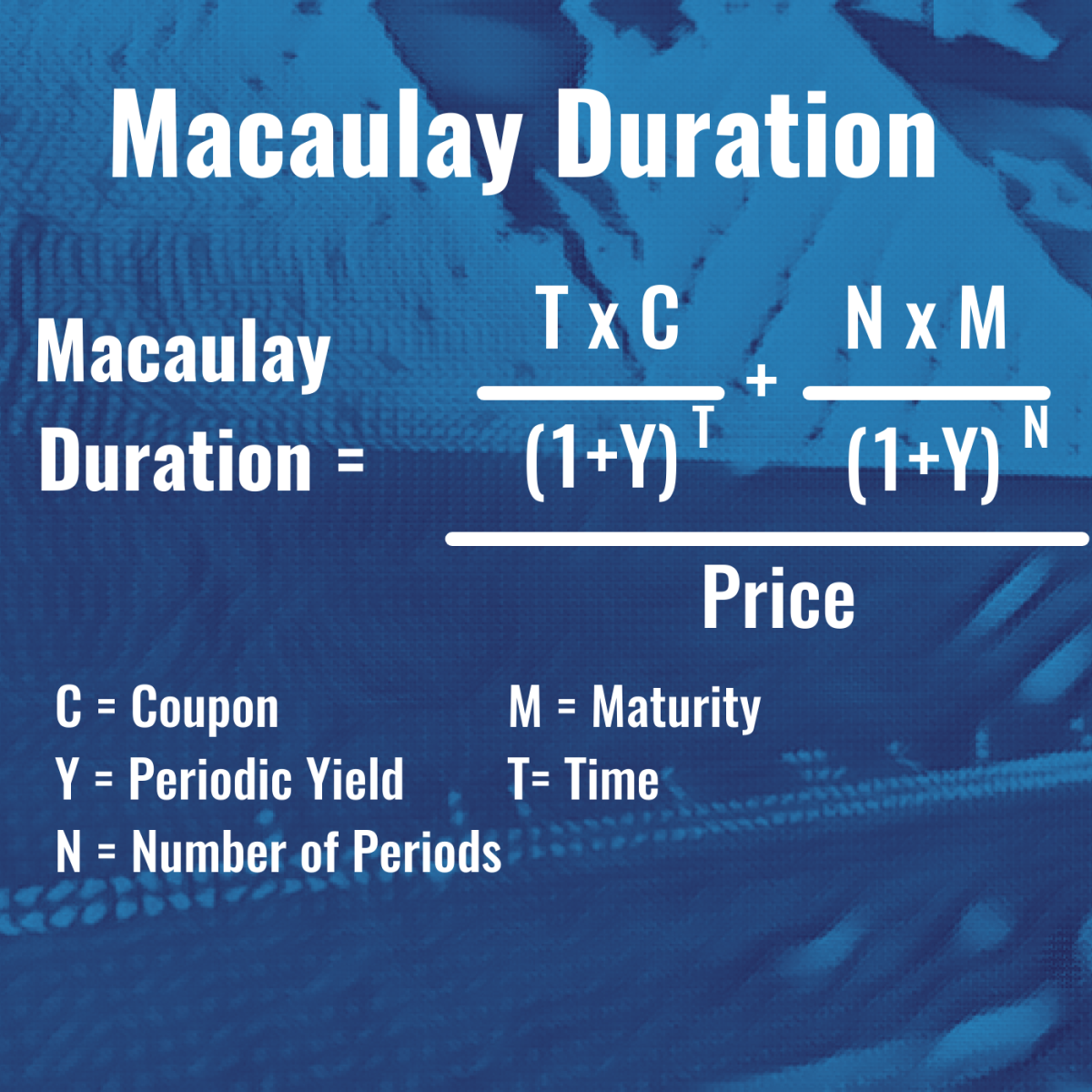

Macaulay Duration - Overview, How To Calculate, Factors Modified duration can be calculated by dividing the Macaulay duration of the bond by 1 plus the periodic interest rate, which means a bond's Modified duration is generally lower than its Macaulay duration. If a bond is continuously compounded, the Modified duration of the bond equals the Macaulay duration. In the example above, the bond shows ...

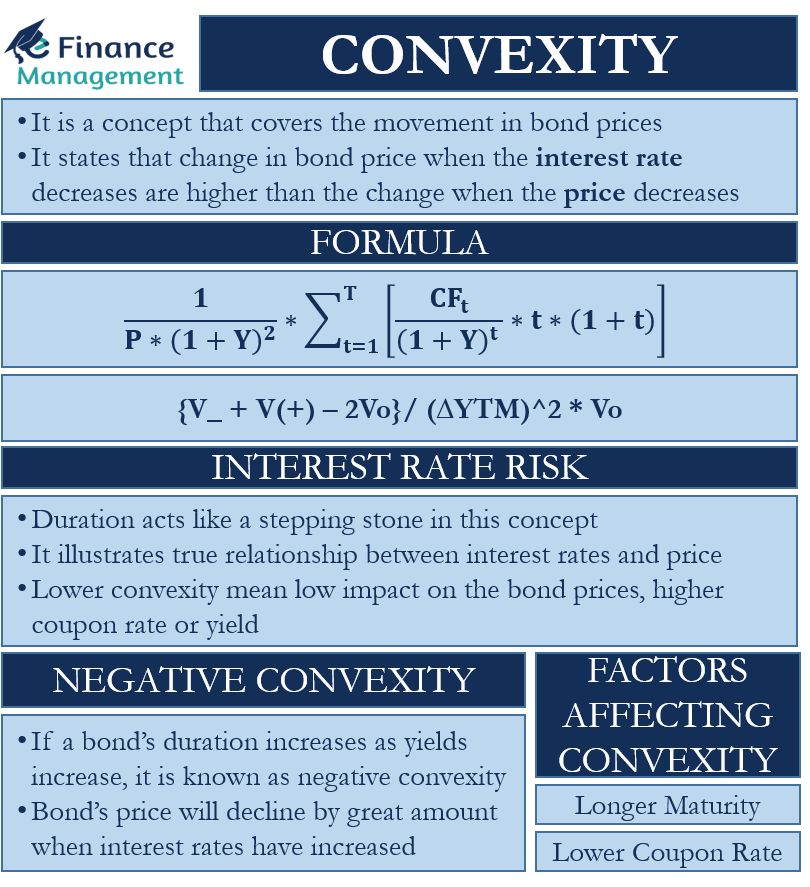

Convexity of a Bond | Formula | Duration | Calculation - WallStreetMojo The duration of the zero-coupon bond which is equal to its maturity (as there is only one cash flow) and hence its convexity is very high; While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a ...

Duration Definition and Its Use in Fixed Income Investing - Investopedia 01.09.2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

exploringfinance.com › calculate-bond-durationHow to Calculate the Bond Duration (example included) Jul 23, 2022 · FV = Bond face value; C = Coupon rate; t i = Time in years associated with each coupon payment; Once you calculated the Macaulay duration, you can then apply the following formula to get the Modified Duration (ModD): MacD ModD = (1+YTM/m) Example of calculating the bond duration. Imagine that you have a bond, where the:

How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Bond Duration Calculator - Exploring Finance Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually (1) What is the bond’s Macaulay Duration? (2) What is the bond’s Modified Duration? You can easily calculate the bond duration using the Bond Duration Calculator. …

Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments.

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

:max_bytes(150000):strip_icc()/Duration_final-5225be866f9543a9b4b957620c475cd5.png)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "45 duration of a coupon bond"