38 are zero coupon bonds taxable

Login - David Lerner Associates Municipal Bonds: Credit Analysis; Taxable Municipal Bonds; Spirit of America Mutual Funds; Energy Resources 12; ... Zero Coupon Bonds. Assessing Risk; Learn about ... Corporate Bonds: Meaning, Features and Benefits - BondsIndia Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond, others are considered as Non-investment Grade Bond. Coupon rate: Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7% (AAA rated) to 12% (A rated) coupons in the current year 2021. On the contrary, G-secs provide a 6% coupon ...

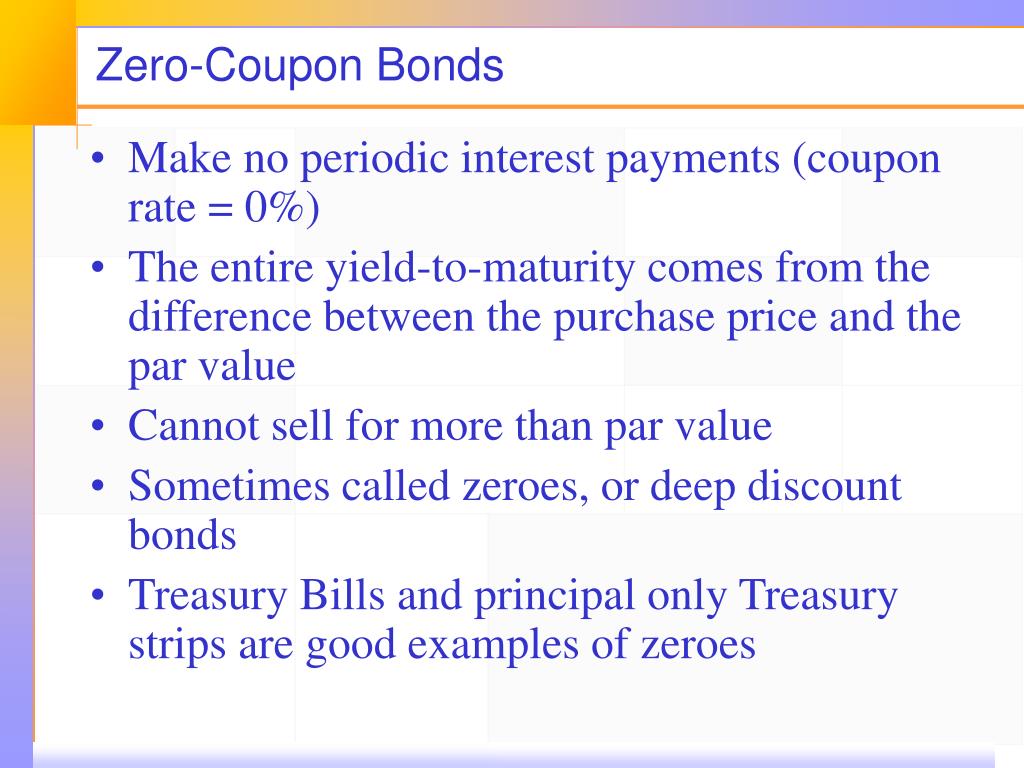

Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and …

Are zero coupon bonds taxable

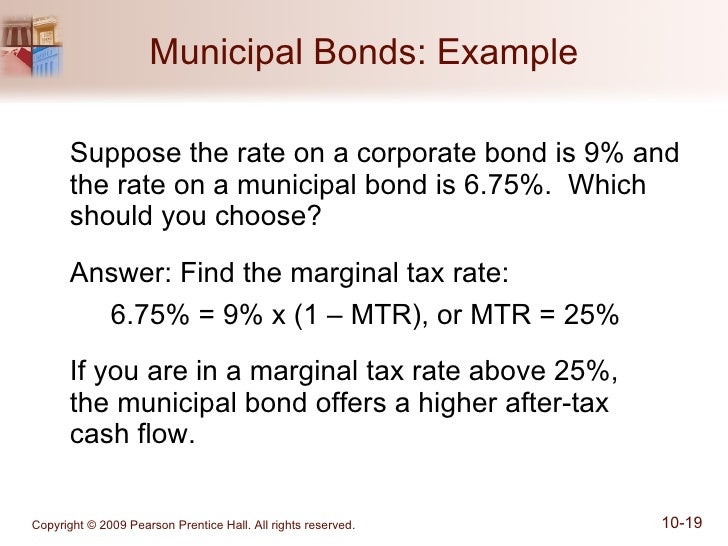

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing … Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ... Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 Jan 08, 2021 · Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax ...

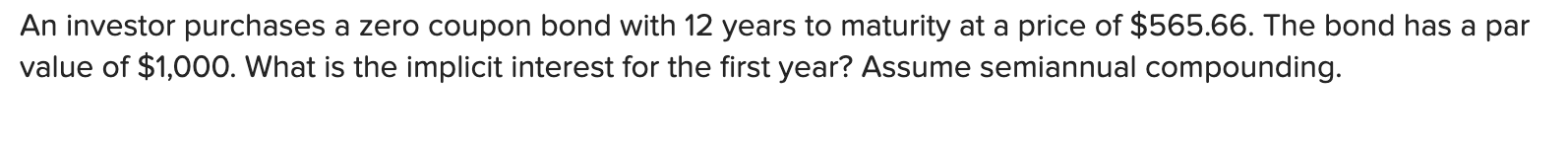

Are zero coupon bonds taxable. Bond Yield to Maturity Calculator for Comparing Bonds The interest is not taxable on the state level, but is taxed by the federal government. ... Zero Coupon Bonds. This is simply any type of bond, government or corporate, that makes no interest payments over its term. Instead, it is sold at a considerable discount to its par value. For example, a $1000 bond might be traded on the open market at a cost of $600, to be paid in full after 10 … Government Bonds: Types, Benefits & How to Buy Government Bonds Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. GST F5 Filing Page - Default Standard-rated supplies refer to taxable supplies of goods and services made in Singapore. GST is charged on these supplies at the prevailing GST rate. The value to be included in Box 1 should exclude any GST amount. For example, if you sell goods for $100 with $7 of GST, you should include $100 in Box 1 and, $7 in Box 6. Examples of standard-rated supplies are: • Supply of … US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ...

How Are Municipal Bonds Taxed? - Investopedia 17.01.2022 · Zero-coupon municipal bonds, which are bought at a discount because they do not make any interest or coupon payments, don’t have to be taxed. In fact, most aren't. As long as you’re investing ... Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 Jan 08, 2021 · Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax ... Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing … Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ...

Post a Comment for "38 are zero coupon bonds taxable"